Thesis: Anatomy of a Biotech Bear

A call to limit our negativism in biotech

This piece was guided by Howard Marks memos, “The Limits to Negativism”, “Bubble.com”, and “Taking the Temperature”; Bruce Booth blog posts, “Biotech Venture Creation”, “Biotech Risk Cycles”. Special thanks to Wesley Keelan on helping guide macro analyses.

As an amateur camper, I must confess I have never run into a bear before. I’ve seen more financial bears, and they’re surely scarier than a real bear. Today, we’re seeing one right now in the biotech industry.

It is doom and gloom season, and for good reason. Portfolios are being shredded, companies are being destroyed, and careers are uncertain. Unlike a real bear, we can’t pull out the bear spray and yell at this one.

As pessimism has gotten worse over the decline of the industry in the last 5 years, today is a great time to look at the bear. Avoiding bears preserves wealth, but buying great companies in a bear market, given the great potential outcomes from biotech, is very profitable.

—Andrew Hui

You can find the thesis in the PDF attached or within this post itself. Do let me know what your thoughts are in the comments, I am looking forward.

1. The anatomy of bubble.com

2. Biotech today is the inversion of bubble.com

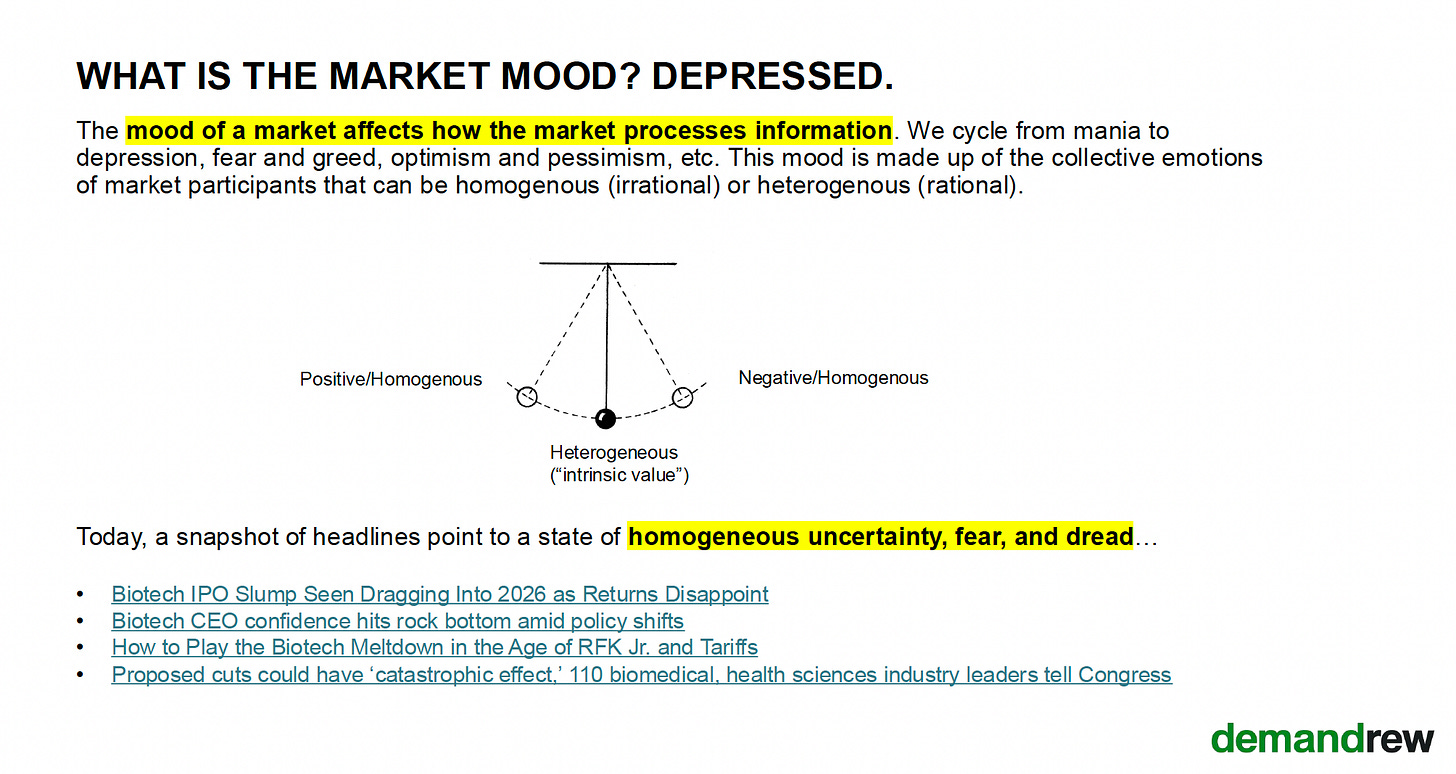

3. What is the market mood? Depressed.

4. Skepticism calls for optimism when pessimism is excessive

5. The market thinks biotech will disappear, do you agree?

6. By watching the bear, we can observe the points that signal the market can only get better

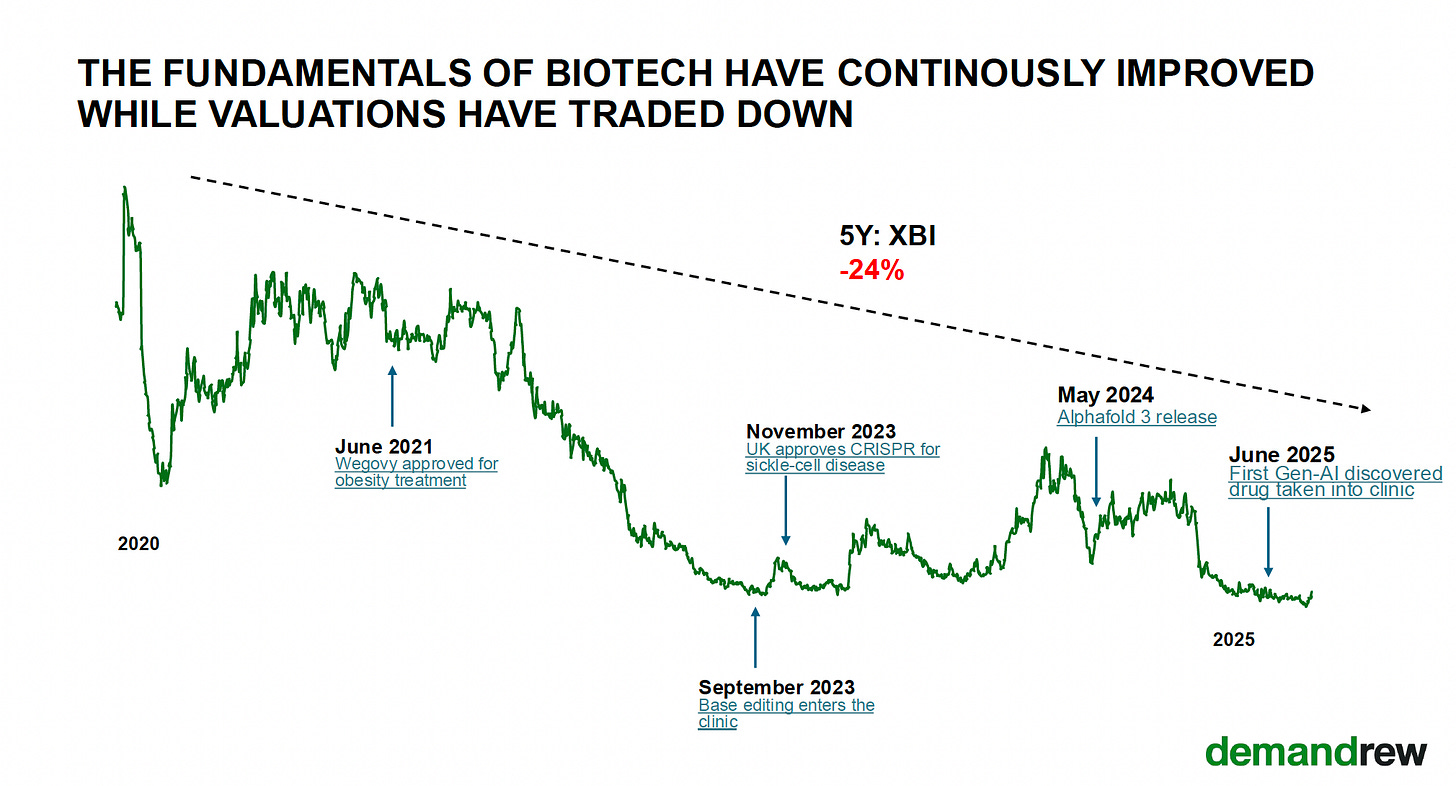

7. The fundamentals of biotech have continuously improved while valuations have traded down

8. Today is the age of national capitalism

9. The new FDA is all about being fast and furious

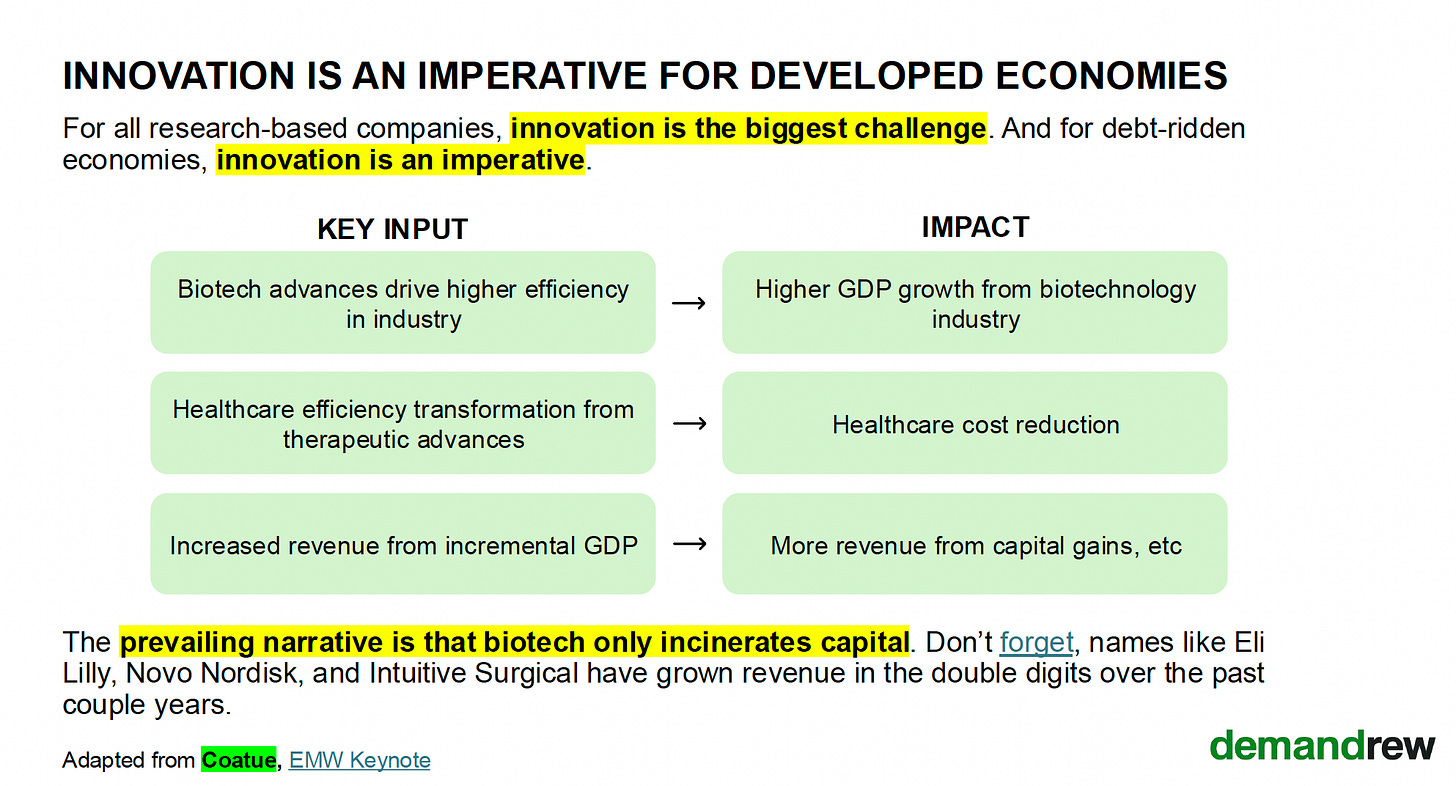

10. Innovation is an imperative for developed economies

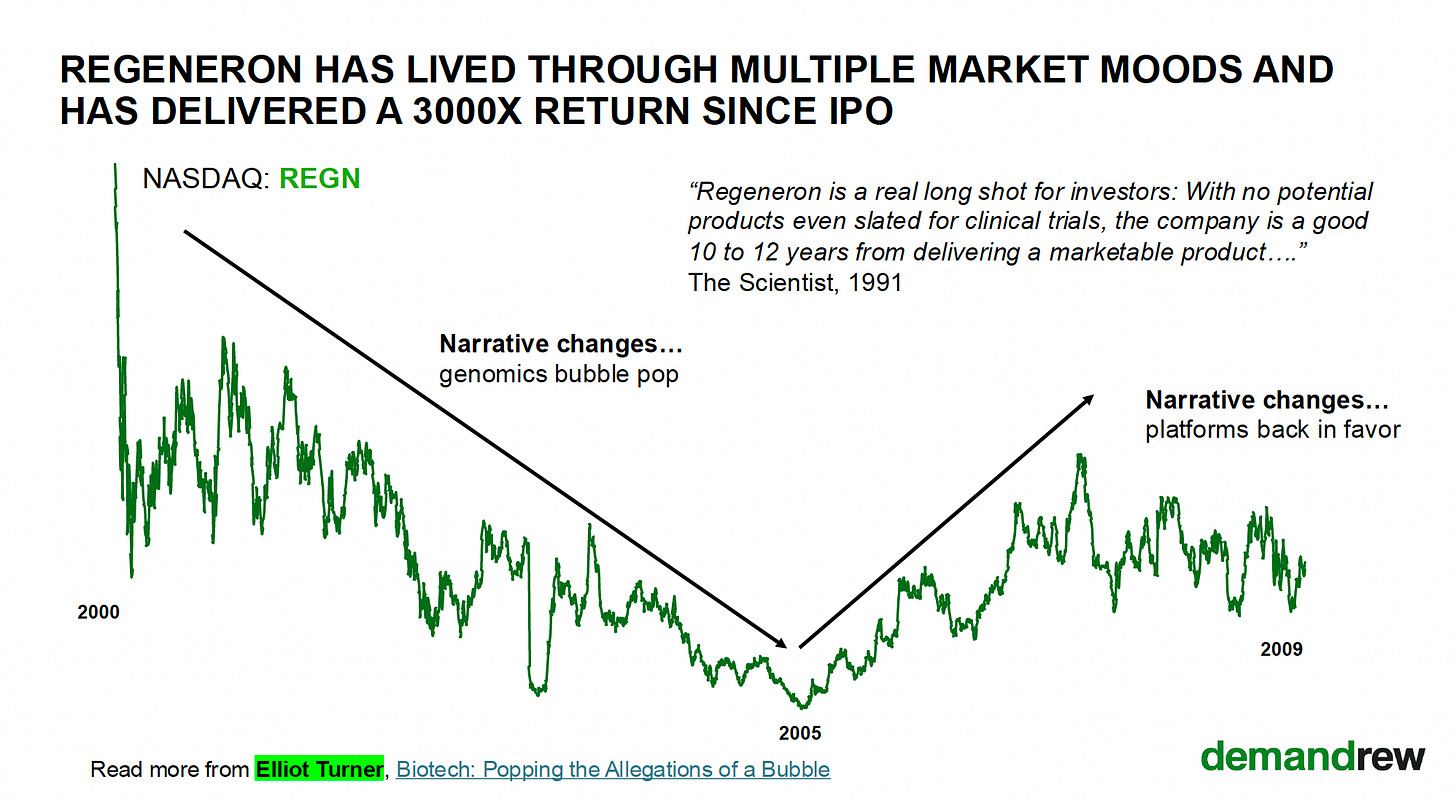

11. Regeneron has lived through multiple market moods and has delivered a 3000x return since IPO

12. If you don’t do macro, macro does you

Disclaimer: The information in this post is not intended to be and does not constitute investment or financial advice. You should not make any decision based on the information presented without conducting independent due diligence.