Thesis: Biotech is the business of capital efficiency

A thesis on the system of toll bridges in biotech

A special thanks to the Analogue Group, Jolie Gan, Vishal Sethi, Viraj Chhajed, and Wesley Keelan for their thoughts during the drafting process.

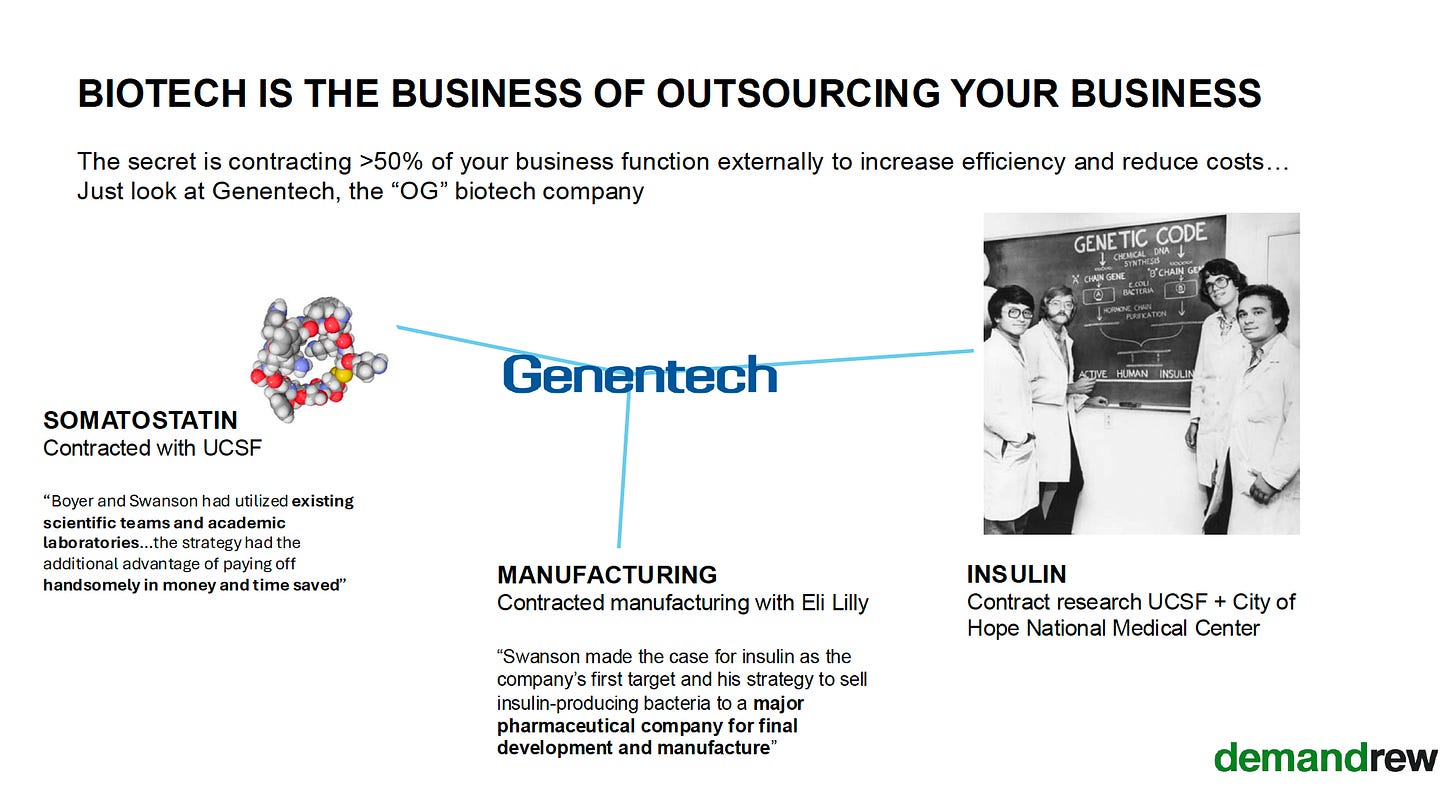

WTF happened to biotech? I’ve been fascinated by the increasing reliance on third parties in the development of biotech assets. The modern “biotech company” can just be an email address managing a project. Just sign contracts with a bunch of contract organizations and they’ll get the job done for you.

Is the dream of building a new big pharma company dead? The dream ushered in by the success of Genentech. This thesis is an exploration of the biotech system’s quest for capital efficiency. And more curiously, will it change?

—Andrew Hui

1. Biotech is the business of outsourcing your business

2. Contract research is the toll bridge of biotech

3. Why outsource? You got to go fast

4. You need to go fast because time is limited

5. You either move fast or go bankrupt

6. The system incentivizes efficiency

7. Efficiency manifests in how the market rewards companies

8. The system will optimize for speed and efficiency

9. The picks and shovels of efficiency will be rewarded

10. Where to invest?

Before you go…

If you’ve got any thoughts, questions, or feedback, please drop me a line - I would love to chat! You can find me on X at @backshui or email (andrewhui65 [at] gmail).

If you are interested please subscribe. I will be counting on you to influence what I research…

i like the format, i like the concepts - it’s like taking a biotech 101 class at Harvard! good work!