Thesis: Optionality in Biotech is Undervalued

A thesis on learning how to dance on the grave of biotech

This piece was guided by “A Framework for Understanding Optionality” from Shawspring Partners. Special thanks to Wesley Keelan and Shoumik Dabir for helping ideate as part of their “Liquid Venture for Public Markets strategy” and the Analogue Group for helping guide the piece with their framework on optionality.

So I’ve been browsing r/Biotech lately (thank you, Alexis Ohanian) and the homies are depressed. I’m sure we know people that went into the biology with a dream… and we ended up with many PhDs, so little academic positions, and now, so little biotech positions.

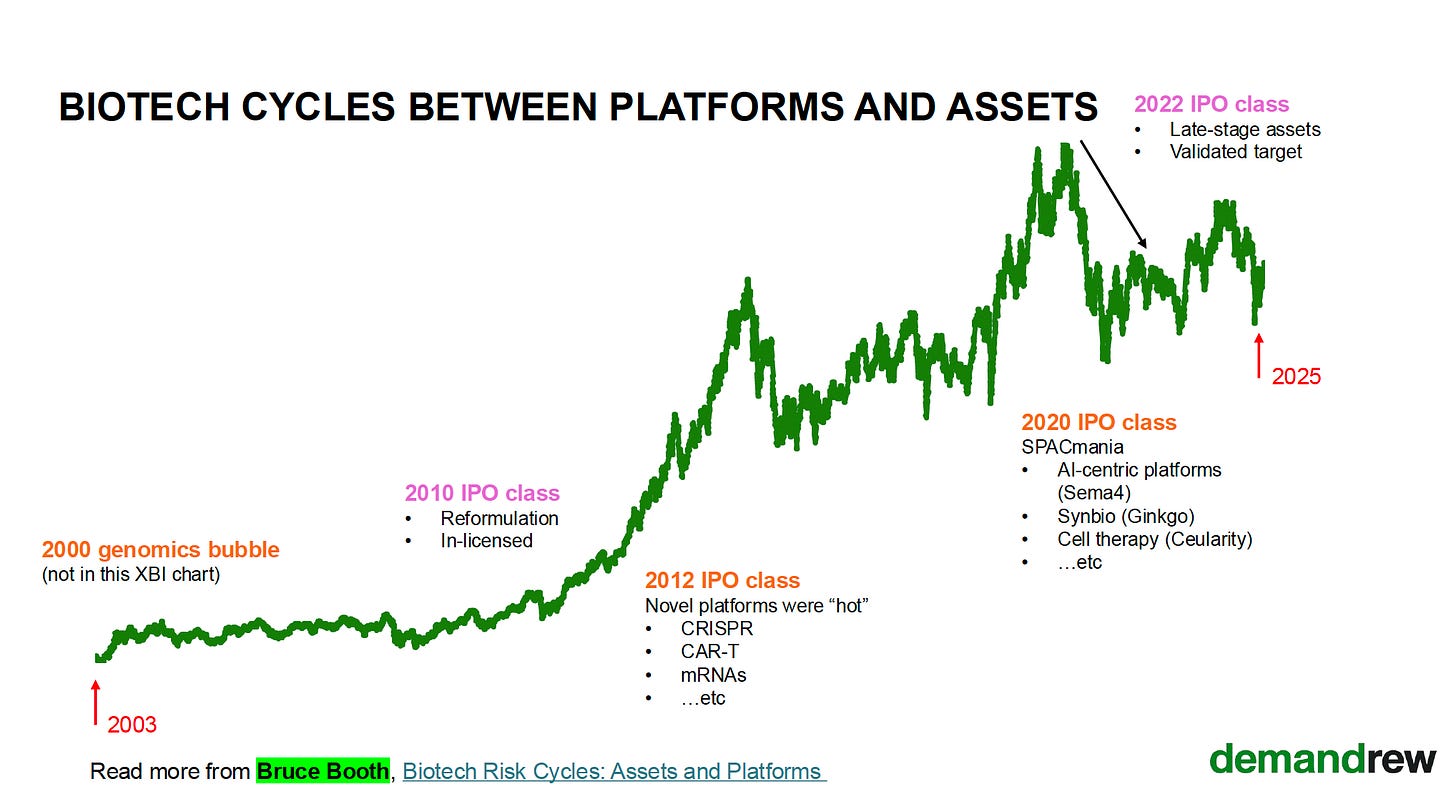

The story of biotech is the story of a cycle. Company formation is tied to the availability of funds. So time of easy money, excess company creation follows; during times of tight money, Darwinian selection, and bad companies die off.

Well… opportunity arises from every adversity, and biotech is no exception. Great companies and technologies are being punished along with the unsophisticated and incompetent teams. This thesis is a call to view the adversity biotech as a buying opportunity to support the companies and technologies of the future.

—Andrew Hui

You can find the thesis in the PDF attached or within this post itself. Do let me know what your thoughts are in the comments, I am looking forward.

1. Biotech cycles between platforms and assets

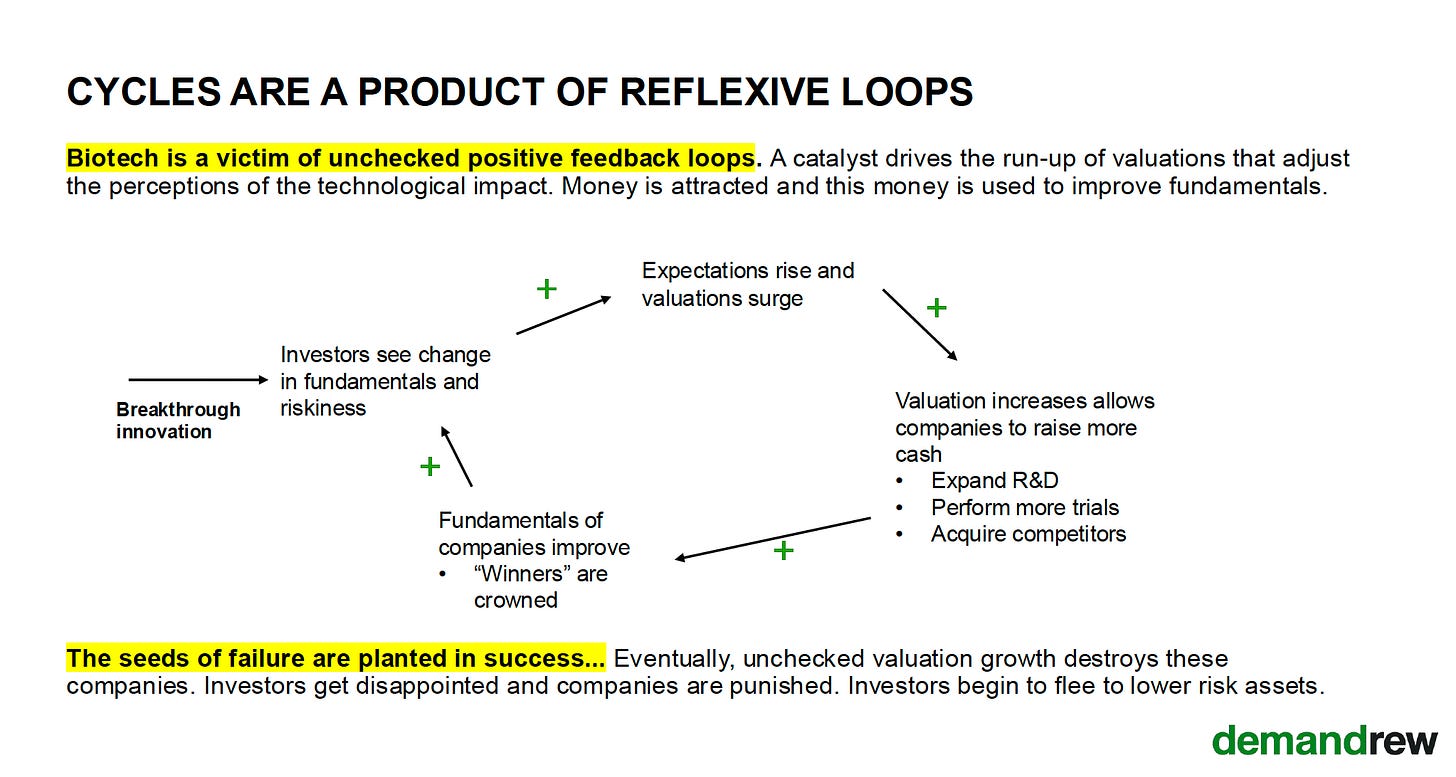

2. Cycles are a product of reflexive loops

3. Price reflects narratives and corrections undervalue optionality

4. Underpriced optionality only occurs in companies with unknowable and unknown futures

5. A framework for understanding optionality

6. Biotech companies are in a cyclical downturn with an unknowable and unknown future

7. “Transformational” advances have been punished for failing to live up to the hype

8. Knowing the strike conditions of an option is valuable

9. But not all optionality creates value

10. In conclusion

Before you go…

If you’ve got any thoughts, questions, or feedback, please drop me a line - I would love to chat! You can find me on X at @backshui or email (andrewhui65 [at] gmail).

If you are interested please subscribe. I will be counting on you to influence what I research…